feel safe and secure by owning your first home with low deposit

low deposit scheme helping hard working aussies buying their first home

Testimonials

Template staging streamlines your mortgage journey, providing clear, customizable steps from application to approval. With structured guidance and personalized options, it ensures a smooth process for confident, informed decisions. Get ready for a hassle-free path to the perfect mortgage fit.

Streamlined Application Process: Templates simplify each step, making it easy to progress from application to approval.

Personalized Loan Options: Customize your loan experience with staging that highlights the best choices for your financial needs.

Clear, Transparent Guidance: Templates are designed to offer clear information, eliminating confusion and promoting informed decisions

Enhanced Customer Experience: A staged journey ensures that you’re fully supported from the initial inquiry to loan closing.

Focused on Approval Success: Each template is structured to maximize your likelihood of loan..

Frequently Asked Questions

What documents do I need to apply for a mortgage?

You’ll typically need proof of income, bank statements, tax returns, and credit information. Specific requirements may vary by lender.

How much can I borrow for my mortgage?

Your borrowing amount depends on your income, credit score, down payment, and debt-to-income ratio. A pre-approval can give you a clearer estimate.

What’s the difference between a fixed-rate and adjustable-rate mortgage?

A fixed-rate mortgage has a steady interest rate throughout the term, while an adjustable-rate mortgage (ARM) has a rate that may fluctuate after an initial fixed period.

How long does the mortgage approval process take?

The timeline can vary but generally takes 30-45 days, depending on factors like document verification, appraisals, and lender-specific processes.

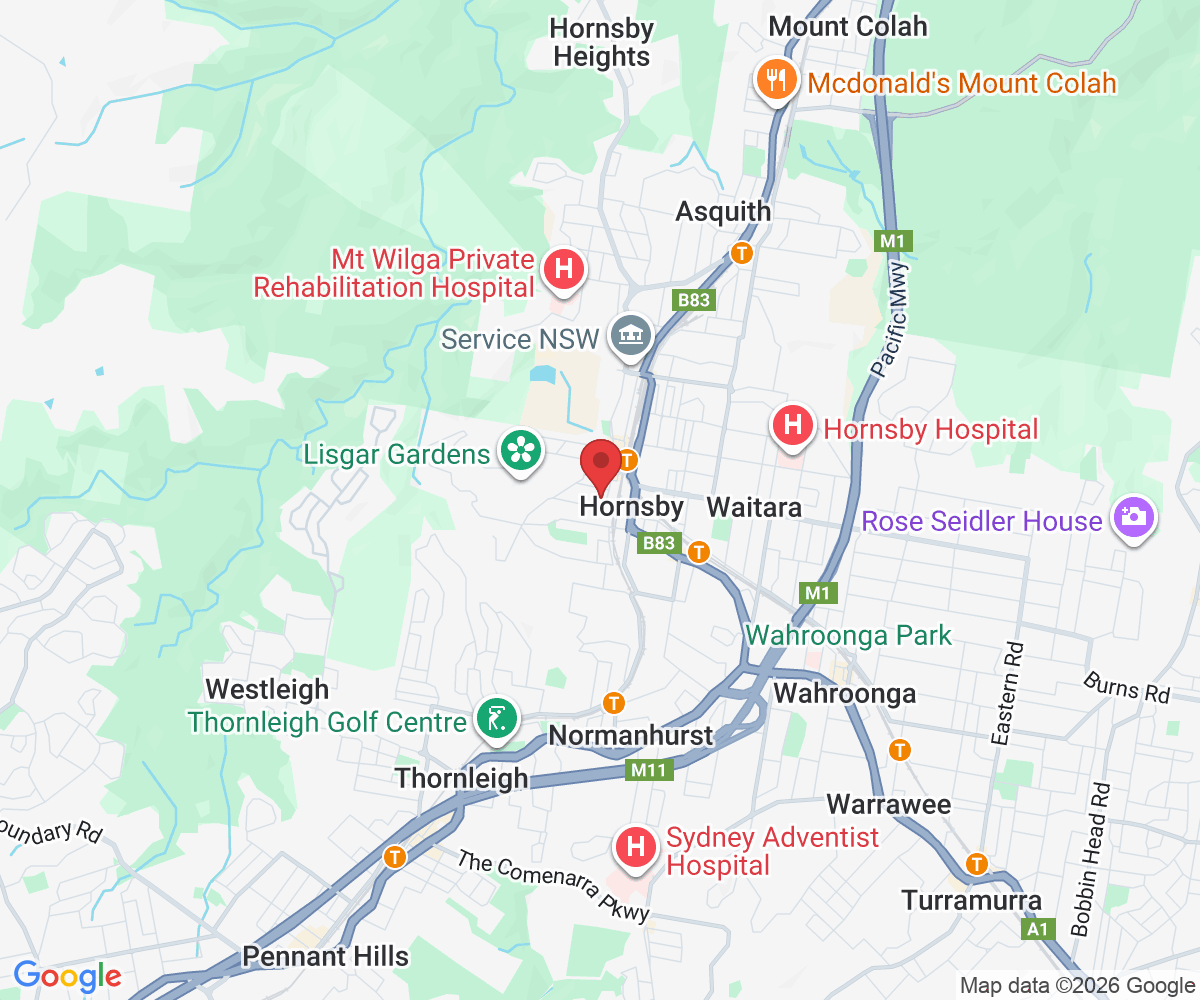

Location: 8/10-16 Forbes Street, Hornsby, Sydney NSW 2077

Call 0433 434 583

Email: [email protected]

Site: www.personalisedfinance.com.au